What Should a SaaS Balance Sheet Look Like? (with Template)

Warren Buffet is famous (among other things) for starting his financial analysis of a company with the balance sheet. While the income statement can tell you how much money a company makes in a given period, the balance sheet reveals how efficient and effective the company is at making its revenue. The balance sheet reveals the long-term health of the company.

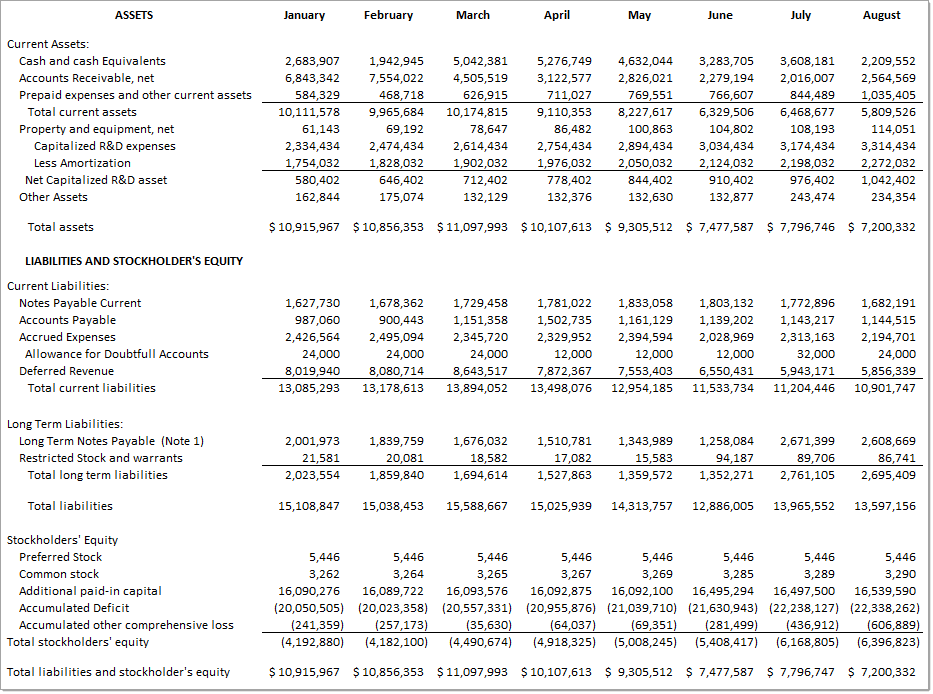

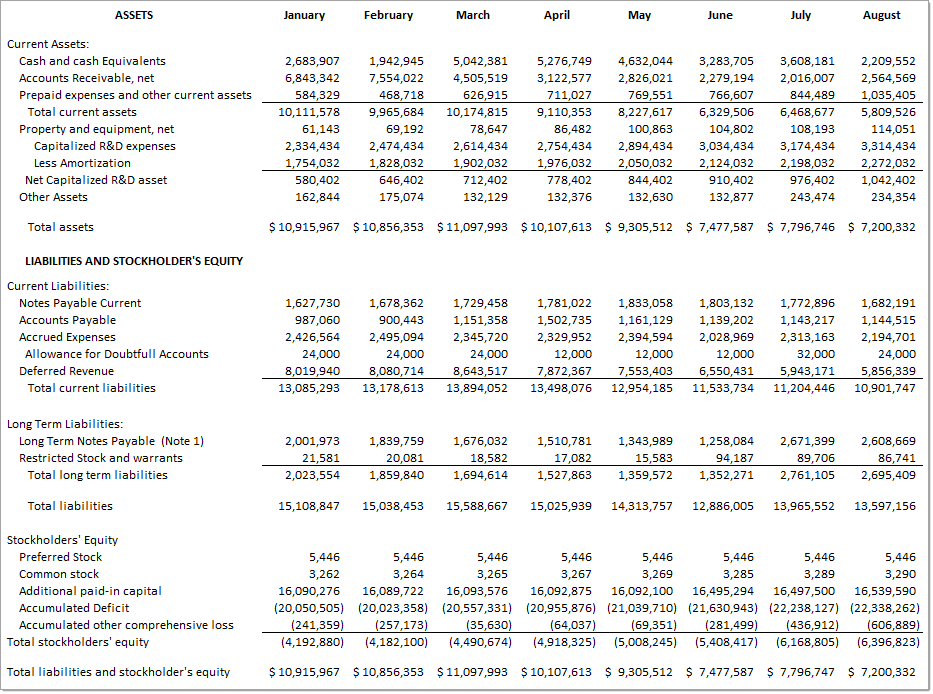

It is important for SaaS finance teams to present a concise and coherent balance sheet so that executives, board members, and existing or potential investors can quickly comprehend the past and current performance of the company. The balance sheet for a SaaS company is less idiosyncratic than the income statement, but there are still several key things to be aware of when building and sharing this financial statement. Below is what we think a SaaS balance sheet should look like. Pair this with what we think a SaaS income statement should look like for a consistent approach to SaaS company reporting across financial statements.

How Should a SaaS Balance Sheet be Organized?

The balance sheet reports stock values at a point in time as opposed to the income statement, which reports flows over a period of time. As such, the balance sheet can provide a more useful snapshot of the aggregate financial standing of a company than the income statement. That said, for maximum comprehension, stakeholders still need to see how the balance sheet has evolved over time and for this, it is necessary to present balance sheet data across time (just like it is presented on the income statement). Also, like in the income statement, many sections can be collapsed into one aggregation, whereas analysts need expanded breakouts in other sections. The goal is to maximize the signals from the balance sheet relative to the noise of extraneous detail. Stakeholders want to see:

- Monthly granularity, or at least apples-to-apples granularity with the other financial statements.

- Assets aggregated into fairly large buckets – SaaS companies generally don’t have a lot of assets ;).

- Expanded detail around capitalized and amortized software development costs and sales commissions, if any.

- More detail in the Liabilities section, but only for the longer-term, strategic accounts.

- Clearly presented Allowance for Doubtful Accounts and Deferred Revenue accounts.

- More detail in the Equity section than is often assumed.

It is the finance leader or CEO’s job to present exactly the right amount of information – enough that the board member or prospective investor can understand the company’s situation and history, but not so much that they are unable to quickly and efficiently review the data and identify the key figures and trends. For bookkeeping purposes, your company will no doubt maintain numerous detailed accounts to accurately track specific assets, liabilities, revenue streams, and cost centers. But at the managerial level, what should an effective subscription-based balance sheet report look like?

SaaS Balance Sheet Example

Below is a fictional, but realistic SaaS company balance sheet organized correctly for understanding the historical and current health of the business.

(Note: you can download a SaaS Balance Sheet template at the end of this post.)

The balance sheet above follows several key guidelines:

- Periodic Granularity. The balance sheet presents data at monthly-level granularity, in a series, in Excel. In SaaS, trends are key, so monthly is the right level of detail, especially for early-stage, fast-growing companies. Quarterly and Annual-level data is insufficient to track meaningful trends, issues, and opportunities in a SaaS company that is only 2 to 5 years old. If you don’t close your books on a monthly basis, well, you need to start. A PDF of the balance sheet, a read-only file, or even an Excel spreadsheet with the formulas pasted as values are hostile presentation styles. At best, they make the job of the stakeholder or investor harder, and at worst they engender a lack of trustworthiness, like you are trying to hide something in the numbers. A simple Excel export from QuickBooks with all the formulas intact is both the easiest and best sharing option.

- Appropriate Aggregation of Assets. Not all accounts on a balance sheet need to be broken out as separate line items. As we mentioned above, the goal is to provide the right amount of detail on key items without overwhelming the audience. For example, while a company may maintain bank accounts across multiple banks and have holdings in short-term (less than 90 days) US Treasury Bills and money markets, a separate line item for each account is unnecessary. In this case, a single aggregated value for “Cash and Cash Equivalents” will suffice. The same is likely true for “Property and Equipment” as SaaS companies operate capex-light businesses. Of course, there can be exceptions to the above. If there is a particular account of importance to understanding the business, it should be broken out and reported as its own line item. This is more art than science and it is up to the CEO/CFO to identify the material accounts that need to be broken out, but they should do so with the goal of maximizing the signal to noise ratio.

We highlight a couple of key balance sheet account areas that typically deserve expanded detail, below.

- Separate Line Items for Capitalization and Amortization of Software and Sales Commissions. One area of the Assets section which requires greater detail is capitalized expenses. The two main categories to be aware of are capitalized software development costs and capitalized sales commissions. ASC 606 requires companies to capitalize sales commissions that meet certain criteria. From a managerial perspective, capitalizing software development expense is at the discretion of the company.[1] Capitalizing expenses essentially means allowing the majority of the cash cost of an expense to bypass the income statement and instead be placed on the balance sheet as an asset, which will be amortized (and fed through to the income statement) over time. If your company is capitalizing these expenses, they should be recorded clearly as accounts (along with related accumulated amortization) on the balance sheet. This allows one to quickly identify the magnitude of any such capitalization and develop a sense for how this has impacted results reported in the income statement, and ultimately, the cash burn or profitability of the company.

- Deferred Revenue and Allowance for Doubtful Accounts. Executives, board members and prospective investors will want to see a separate account for any Deferred Revenue or Allowance for Doubtful Accounts. Deferred Revenue is possibly the most important line item on a SaaS company’s balance sheet. It is a non-negotiable separate account item in the Liabilities section for any SaaS company. You may even want to have several accounts for individual business lines. It is essential for understanding the company’s revenue model as well as bookings growth or decline. It is also a critical component to calculating the true cash burn of a company as the company receives the cash upfront but only recognizes the revenue on the income statement over time. As with many of these “special cases” where we encourage expanded detail, truly proper GAAP accounting will necessitate allocating deferred revenue between long-term and short-term accounts, and while that is sub-optimal from an analyst’s perspective, it is the GAAP code and should be done. A breakout of any Allowances for Doubtful Accounts quickly highlights whether the company has provisioned for doubtful accounts historically, how this has matched subsequent write-offs and how the company is currently provisioned. It can provide some insight into the quality of the company’s revenue and the ability of the company’s customers to meet their obligations to the company.

- Greater Detail in Long-Term Liabilities. Like bank accounts and cash equivalents, stakeholders do not need to see a detailed breakdown of credit cards, accounts payable or other operational day-to-day current liabilities. Board members, existing and prospective investors, and lenders instead focus on longer-term, strategic liabilities and will want to see adequate detail to understand and analyze the company’s financing history. Different tranches of loans, particularly if from different lenders, should be shown in separate accounts. Convertible notes should be reported separate from bank debt.

- More Detail in the Equity Section. The Equity section contains important information on both the money invested in the company as well as the company’s income generation over time. As such, SaaS balance sheets should clearly indicate preferred stock, common stock and additional paid in capital for the company. This allows a reviewer to identify the “structure” of equity financing and develop a sense for the company’s equity efficiency. Similarly, the Retained Earnings account (often Accumulated Deficit for companies that have not achieved profitability over the lifetime of operations) should be presented as a separate line item to allow for a quick assessment of the trend in income generation over time.

A SaaS balance sheet statement should be concise and consistent in order to be meaningful to internal and external stakeholders. Consistent reporting helps business owners better run their SaaS companies and helps investors better understand the business, which leads to quicker decisions. While the balance sheet is not as idiosyncratic as the income statement for SaaS companies, there are several key items and best practices that SaaS companies should follow. Pairing this piece with our prior post on the SaaS income statement should help SaaS companies present a clear and easily digestible set of financial statements for their internal and external audiences. The template below gives you an example of how we, at SaaS Capital, prefer the balance sheet presented.

Click Here to Download the SaaS Balance Sheet Template

[1] Companies may have to capitalize software development costs for tax purposes. We have presented our perspective on capitalizing software costs previously here. It can be summarized as: Don’t capitalize software development if you can avoid it. From a managerial perspective, capitalizing software expense muddies the waters when it comes to assessing the ultimate cash uses and needs of a business – something most early or growth-stage B2B SaaS companies need to understand clearly.

![]()