The Great FinOps Suite Vs. Stack Debate

For years, operating out of an ERP was seen as an obvious indicator of a “mature” or “serious” business, but that may no longer be the case.

As early-stage and mid-market SaaS companies continue to navigate an ever-changing, volatile market, finance teams need solutions that allow them to prioritize flexibility and scalability above all else. The relative rigidity of ERPs and suite solutions means these aren’t always the perfect fit for growing businesses that need to move fast—kind of like trying to wear a shoe that’s one size too big.

In some cases, investors may require you to use an ERP, or an ERP is adopted by finance teams solely for its general ledger capabilities. However, building and improving upon an existing tech stack for your financial operations allows you to take advantage of individual point solutions that are better equipped to manage SaaS-specific billing, revenue recognition, metrics, etc. By building a tech stack to manage these functions, finance teams can bypass the modules predefined by an ERP and use their ERP only for basic controls and financial management.

Why take on a full, rigid suite when you can continue to develop an ecosystem of integrated finance tools? Let’s take a look.

Early-stage and mid-market companies dont have to jump straight to an ERP anymore. Today, everything integrates!

Until recently, many B2B SaaS businesses believed the best way to relieve their spreadsheet pains was to implement a dedicated ERP or suite solution that could warehouse all their financial data. However, with advancements in APIs and seamless integrations, boxing your business into a full suite is no longer the only (or best) solution.

ERPs like Netsuite and Intacct are fantastic at offering financial control. They also provide a perceived level of maturity that investors love—and sometimes require. If your company is quickly approaching the enterprise stage, an ERP may be the way to go. Where ERPs fall short is their inability to address the specific needs of early-stage and mid-market B2B SaaS companies.

Specifically, earlier-stage SaaS companies need:

- Flexible tools that can accommodate rapid changes in their go-to-market strategy

- The ability to pick and choose the finops tools they need (and ditch those they don’t)

- The option to continually reiterate and reinvent their tech stack as business needs change

- Tools with ease-of-use and a smaller learning curve to quickly onboard new employees

Building a new tech stack—or optimizing your existing one—gives you the flexibility to design a custom solution to address your specific needs at the right time (no more, no less) without the obligation of paying for additional ERP modules that end up sitting and collecting dust.

This often leads to a lower cost of ownership, quicker adoption, and higher satisfaction.

Your finance department gets to pick their own tools.

Instead of using the predefined features offered by an ERP, finance teams can pick the tools that work best for their individual processes. Having the flexibility to choose your financial operations tools also significantly impacts your business strategy, especially when trying to align your front and back office teams around your GTM.

ERPs take time and resources to manage.

ERP management and implementation are way outside the expertise of a finance team.

Often, it’s up to an ERP consultant to get the software implemented correctly, conduct training and onboarding, and help finance teams migrate all their existing data into the new system. This process can take several months, which is a huge competitive disadvantage for early stage and mid-market companies that need to remain agile.

Before point solutions, the traditional software suite was seen as the “go-to” solution for finance teams since all its components were already compatible with each other. But now, SaaS tools can be implemented with little-to-no installation or maintenance and are easily accessible through a web browser. As a result, implementing specific tools for specific jobs takes a fraction of the time, and you can eliminate the need for a 3rd party implementation consultant or IT manager.

Additionally, the quick time to value provided by individual SaaS tools allows finance teams to spend less time worrying about managing and implementing their systems and more time plotting their company’s financial roadmap.

Tech stacks are more customized.

As enterprise suites become a less suitable option for early-stage and mid-market SaaS businesses, we’re entering the age of “create your own ERP”—and we’re not the only ones who think so.

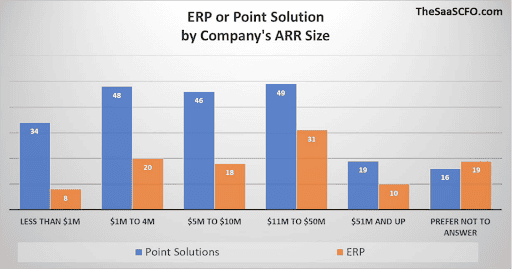

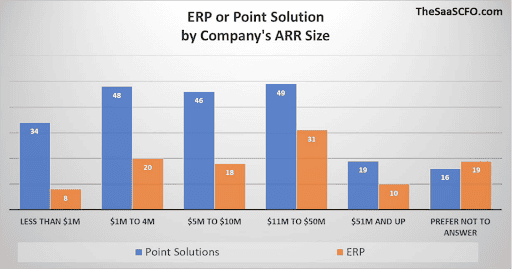

In a survey of 300 B2B SaaS companies, Ben Murray of The SaaS CFO found that early-stage SaaS companies typically prefer best-of-breed point solutions over an ERP.

By delaying the transition to an ERP, you can purchase individual FinOps solutions for specific use cases and expand the depth and breadth of your existing tech stack’s functionality. Even though some suite solutions allow their users to start small and purchase additional modules over time, ERP users are still limited to the features offered within their designated ERP.

Similarly, while large, integrated solutions can affect how organizations approach their financial operations entirely, point solutions usually offer a simpler, plug-n’-play approach that fits into your organization’s existing structures or workflows. For example, supplementing your tech stack with a dedicated finops solution means you can implement financial tools that are tailor-made for your business instead of being stuck with whatever modules an ERP comes pre-packaged with.

Fully integrated financial data across systems.

Despite the clear advantages of building a tailor-made tech stack, many ERP advocates remain convinced that using multiple tools to manage financial data ultimately leads to data silos and slow, manual processes. This is a common misconception.

With the advancement of APIs and iPaaS (infrastructure Platform as a Service) software, end users can set up data flows independently to maintain a singular system of record for key SaaS metrics, billing, and financial data across disparate systems without having to resort to an ERP.

A tech stack keeps teams agile.

Given the current volatile market conditions, cash is king and the ability to remain agile is table stakes. Migrating your current financial data to an ERP not only makes your data less portable, but all the custom developments required to get your ERP up and running make it more difficult (and expensive) even to consider transitioning to another software provider if needed.

Point solutions, however, are interchangeable. In a custom-built tech stack, every piece of software has its designated spot to fill, and you have the freedom to replace it when the need arises. (Again, APIs make this so much easier.)

Think of your tech stack like a car. Rather than having to wait months to import a brand new custom vehicle from overseas (ERP), you can just change out the fuel pump, brakes, and tires as needed and get back on the road in no time.

A tech stack provides greater time to value.

A tech stack embodies the “grow as you go” mentality. Instead of over-extending your capital spend by deploying a suite with more features than you need, your team can start with just the necessities and purchase additional tools as you need them.

Fewer tools to manage equals reduced onboarding time as well. Less time trying to learn the ins and outs of hyper-niche ERP tools and features means you can double down on the tools you already have available and reiterate your financial processes as you grow your business.

ERPs and enterprise tools have a time and a place, but they’re not necessarily the best option for recurring revenue businesses that want to remain agile and achieve scalable growth—especially in our current volatile climate.

By delaying the shift to an ERP and improving the finops tools available in your tech stack, your finance team can avoid the extra work of managing an ERP and spend more time improving your financial processes. In other words, the shift to a tech stack represents a major shift from tactical to strategic execution—which is great for your company’s bottom line.

Not sure how (or why) you should optimize your financial tech stack? Check out this free guide on how to delay your switch to a costly ERP.