AI Adoption Among Private SaaS Companies and Its Impacts on Spending and Profitability

Since the launch of ChatGPT in late 2022, AI has dominated both discourse and funding dollars in the SaaS industry. With opinions ranging from existential threat to limitless opportunity, we were keen to extend our annual survey to cover several questions on AI in order to glean just how it is being incorporated by private SaaS companies and what the impact has been to date on spend. Below are our key takeaways:

- AI utilization is not limited to several large companies or young start-ups. Roughly three-quarters of our respondents are using AI in their day-to-day operations or product.

- The majority of respondents are using limited AI functionality to complement their core software offering, but the role of AI is expected to expand going forward.

- At the margin, AI utilization strategies to date appear to be supporting companies’ drive to profitability rather than a renewed emphasis on growth at all costs.

- Teasing out the impact of AI on particular spending categories is not possible without an understanding of how each company is approaching its AI strategy and accounting for its AI spend.

- Nevertheless, we do note the following broad conclusions when comparing companies with $1–20 million ARR that are using AI in operations and product vs. similarly sized companies using no AI. The former group of companies reported higher COGS as well as selling and marketing costs, and lower R&D and G&A expenses relative to companies not using AI.

AI Adoption has been Broad-Based and is Likely to Accelerate

As part of our annual survey, we asked respondents several questions about their use of AI both in their operations and in their product. Their answers reflect the breadth of AI adoption among our universe of private SaaS companies.

Over 76% of respondents indicated they were using at least some amount of AI in their existing products, and 69% are deploying AI solutions in their day-to-day operations.

Now, it bears stating that what is termed AI can mean vastly different things to different operators; nevertheless, the conclusion is unmistakable: AI (broadly defined) has been widely incorporated by SaaS companies.

This conclusion holds regardless of funding type (i.e., if the company is bootstrapped or equity-backed). There is a slight preference for bootstrapped companies to deploy AI in operations (70% of respondents) compared to equity-backed companies (66%), whereas equity-backed companies were somewhat more likely to have built AI functionality in their product: 79% vs. 71% for bootstrapped companies.

Interestingly, AI adoption in product appears to be the typical first step for companies. While we did not ask respondents to specify the timeline of their AI adoption in operations vs. product, we can derive an informed guess by comparing the number of companies using AI in their product that are also using it in operations and vice versa. Of the companies that deployed AI in their product, 50% were also using AI in their daily operations.

Conversely, 88% of companies that had AI in their operations were also using it in their product. This supports the conclusion that, in general, companies are first deploying AI in their product before implementing it in their daily operations.

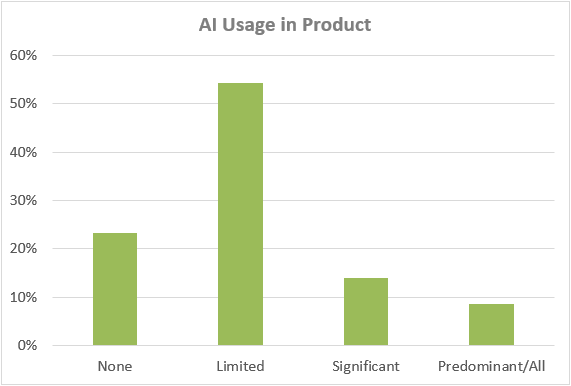

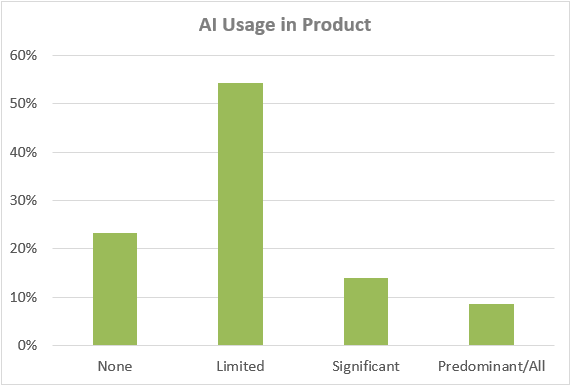

If the breadth of AI adoption is not in doubt, its depth is a more nuanced matter. We asked companies to specify whether AI was a limited, significant, or predominant piece of their product. The majority of companies reported having limited AI functionality around their core software product. Interestingly, the same percentage of companies reported using no AI in their product as the combined percentage of companies that reported their product was either significantly or predominantly/entirely AI.

Again, controlling for whether the companies were bootstrapped or equity-backed does not meaningfully alter the results. Among bootstrapped companies, 52% reported their product used limited AI compared to 58% of equity-backed respondents. There is also a slight increase in the percentage of companies whose product is either significantly or predominantly/entirely AI (21% combined) among equity-backed respondents compared to 18% for bootstrapped companies.

Overall, it should not be surprising that companies have implemented a “limited” approach to AI adoption in their product so far. There are myriad reasons why AI utilization in product is limited so far, but the simplest explanation is that this takes time, and we are not far removed from AI bursting into the mainstream. Retooling solutions can include significant commercial, strategic, and engineering changes. There may also be lingering questions around fit, accuracy, utility, and security/privacy. All of these take time and energy to address. A snapshot of the data may look like companies prefer a limited approach to AI, but at least as of now, this is more likely a pass-through stage of an industry learning to walk with AI before it can run.

In fact, nearly 92% of respondents indicated that they planned to increase their use of AI in 2025.

With this in mind, let’s take a look at how the use of AI has impacted profitability and spending.

AI Adoption and Profitability

AI has the potential to unlock new approaches and efficiencies in how SaaS companies build, execute, and deliver their product, as well as how they go to market.

Effective AI adoption offers the opportunity to create more output for a given input. With this capability, SaaS operators have a choice to deliver the same output with fewer resources or maintain (and even grow resources) to deliver greater output.

Whichever path they pursue will have different results in terms of spend and profitability. Companies may use AI to drive toward profitability while maintaining output, or they may double down on growth. They may also choose to implement different strategies for different components of their business. For example, a company may utilize AI in its Research and Development to reduce resource requirements but simultaneously decide to bolster its Sales and Marketing teams with an eye to growing its market footprint. There is also the added complication of companies potentially allocating AI spend differently across operations or product.

Without knowing the individual priorities and accounting policies of each respondent, it is impossible to draw specific conclusions about the absolute impact of AI on profitability and spending. Nevertheless, we can compare the expense structures and operating profitability for AI adopters vs. non-adopters as a whole to see if any broad observations emerge.

Looking at AI adoption in SaaS product, there is no distinction in profitability between companies using AI and those that are not. Nearly 58% of companies using AI in their product reported operating at or above breakeven. For companies without AI in their product, the equivalent number is 59%. When it comes to usage in product, AI does not appear to be a determinant in aggregate-level profitability at this stage.

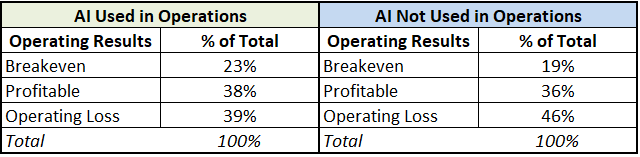

Where a difference in operating results does show up is when we look at whether SaaS companies are implementing AI in their day-to-day operations. Companies using AI in their operations were more likely to be operating at breakeven or profitability (61% of reporting companies) compared to companies that had not incorporated AI in their operations (54%). At the margin, this would support the idea that, at least so far, efficiencies generated by AI utilization in day-to-day operations have more than offset any increased spend related to AI adoption.

Controlling for whether a company is equity-backed or bootstrapped provides additional detail as to how AI may be impacting profitability. The first thing to note for this analysis is that bootstrapped companies are much more likely to operate at breakeven or profitably than their equity-backed peers.

Across the universe of survey participants, 82% of bootstrapped companies are breakeven or profitable compared to 43% of equity-backed companies.

For bootstrapped companies, implementing AI in product or daily operations does not materially alter the percent of companies operating at breakeven or above. Where the impact of AI may be seen more starkly is in the universe of equity-backed companies using AI in their operations or product. Forty-nine percent of equity-backed companies using AI in their operations were operating at breakeven or above (compared to the 43% baseline for all equity-backed companies regardless of AI use). More notable still is that for equity-backed companies not using AI in daily operations, only 29% reported being breakeven or profitable. A similar, though less pronounced, finding occurs when we examine equity-backed companies not using AI in their product. For this cohort, 39% reported operating at breakeven or better compared to the 43% baseline.

A plausible explanation for AI cost efficiencies seemingly manifesting in equity-backed companies more than bootstrapped companies is that, as there are a greater number of equity-backed companies operating at a loss, the realization of cost efficiencies through AI adoption in operations is more likely to push a handful of companies out of operating losses and into breakeven or profitable results. Since there are fewer bootstrapped companies operating at a loss, there are fewer opportunities for these companies to switch from operating losses to profits. A similar pattern may be playing out for AI utilization in product, although to a less pronounced degree.

AI Utilization and SaaS Spending by Category

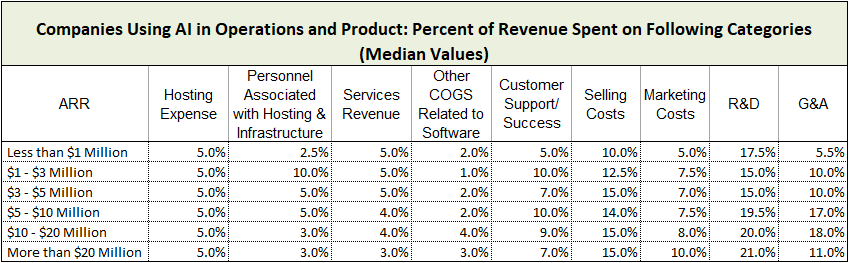

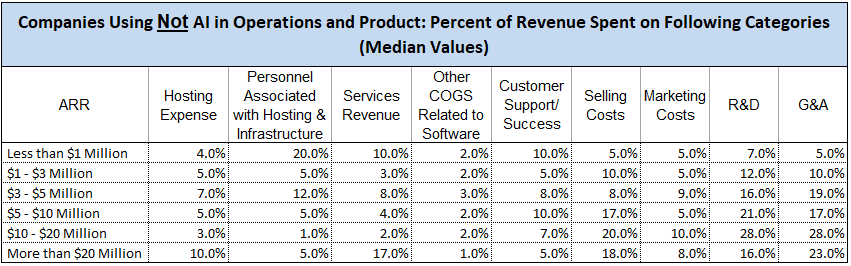

The two tables below present median spending as a percent of revenue for operating categories. Companies are segmented based on the size of revenues and whether they are using AI in both their daily operations and product. Looking at companies using AI across both product and operations serves the purpose of mitigating any accounting allocation discrepancies between operations and product among companies. In this way, it can provide a cleaner, holistic picture of how AI is impacting companies’ expenses.

As this is the first year for which we have collected this data, we lack a historical comparison. Nevertheless, the data can serve as a reference for companies against which to compare their spend. We note, however, that the definition of AI, its purpose (i.e., toward growth or efficiencies), and how it is allocated across expense categories may vary among respondents.

Within the group of companies that are not using AI in either their product or operations, the sample size is particularly small for companies with ARR less than $1 million and with ARR greater than $20 million. Ignoring these categories and lumping all companies with ARR between $1-20 million gives us a broad overview of how AI implementation has affected spending by expense category. Several outcomes emerge that match the anecdotal data we have gathered from conversations with operators and industry participants.

Companies that have implemented AI across operations and product have a slightly higher spend on Cost of Goods Sold. Elevated customer support/success costs are the main driver. We have heard from multiple sources that rolling out AI in product requires more significant customer success/support staffing, as the increased functionality provided by AI can result in a steeper learning curve for customers and, therefore, increased costs for SaaS companies that want to ensure customer usage and ultimately retention are maximized. While not definitive, the data are consistent with this explanation.

Similarly, sales and marketing expenses are higher for companies using AI in their product and operations. A potential explanation for this is that these companies are aiming to “strike while the iron is hot” with regard to the interest and opportunity around AI and are staffing up their sales teams and increasing their marketing budget to accelerate new sales and upsell opportunities.

The areas where AI adoption has led to reduced spend on the whole are R&D and General and Administrative (G&A) expenses. One of the low-hanging use cases for AI commonly identified is as a “coding assistant” for engineers. Multiple portfolio companies have reported significant efficiency gains among their development teams after incorporating AI. Of course, implementing AI may also require additional and perhaps more expensive staffing requirements, but to date, the efficiency gains from AI incorporation appear to have more than offset any incremental expenses in R&D. This may also lend credence to the idea that, so far, companies have elected to take advantage of AI efficiencies by reducing resources in R&D rather than by maintaining or growing resources to quicken or expand product development.

Lastly, G&A expenses are a natural place to expect greater efficiency potential from AI to manifest in lower spend. Unlike a category such as sales and marketing or R&D, it is less likely that companies would choose to increase G&A resources if AI was making them more efficient. The data bears this out.

Companies not using AI in operations or product are spending 20% more on G&A than their counterparts that have implemented AI.

Conclusion

Adoption of AI has been widespread across private SaaS companies. In the long run, if AI delivers on its promise of increased efficiencies, we should see companies that adopt it be able to optimize on spend. Evidence of this may already be present, for example, when looking at differentials in spending in G&A for companies that have adopted AI compared to those that have not. Nevertheless, the near-to-mid-term impact of AI on spending and profitability is uncertain as companies may implement different strategies for AI utilization – with some electing to reduce spend while maintaining output and others electing to increase spend in an attempt to gain market share or expand into new markets. What is not uncertain is the direction of travel for AI adoption. The private SaaS company universe is set to continue to expand AI usage in 2025.

There may be certain applications and solutions for which AI does not make sense. We are not advocating forcing AI into something simply to follow the trend. However, all companies should have executed a thoughtful analysis on AI for their business and developed a strategy for implementation where appropriate. Based on our survey results, if operators have not done this, they are in danger of falling behind.

![]()