ChartMogul 2024: Year in Review

Here are the highlights from the past 12 months.

I’ve been reflecting on the SaaS industry’s journey in 2024. This year feels like the culmination of our collective move to the final stage of the grief cycle: Acceptance. After the ZIRP-fueled 12-year tech bull run and the sobering crash of 2022, our industry has evolved – and 2025 is shaping up to be the continuation of this new chapter for SaaS.

We’re now living in a more mature, efficient, competitive, customer-focused, and less investor-dependent era. This next phase (let’s call it 2024 → 20XX) could very well define the remainder of my career – and honestly, I’m excited for it.

Here are the highlights that stick out for me when looking back on 2024.

What does good growth look like in 2024?

SaaS companies experienced a boom in growth starting mid-2020 and into 2021. But the growth bubble popped in late 2021 when new business began to slow. Eventually all SaaS companies, regardless of ARR range, would be affected as growth plummeted across the entire industry.

2024 has seen the industry stabilize, with a return to reliable yet modest growth. The legacy of 2022-2023 is an industry that is now leaner and more efficient. Truly great SaaS companies continue to do very well, while companies who were dependent on cheap capital have had to make dramatic adjustments. In some ways I prefer this new normal in SaaS, product innovation is king, hard work and making customers happy is rewarded, and there are just less distortions in the market. I do however miss the growth rates of the ZIRP era.

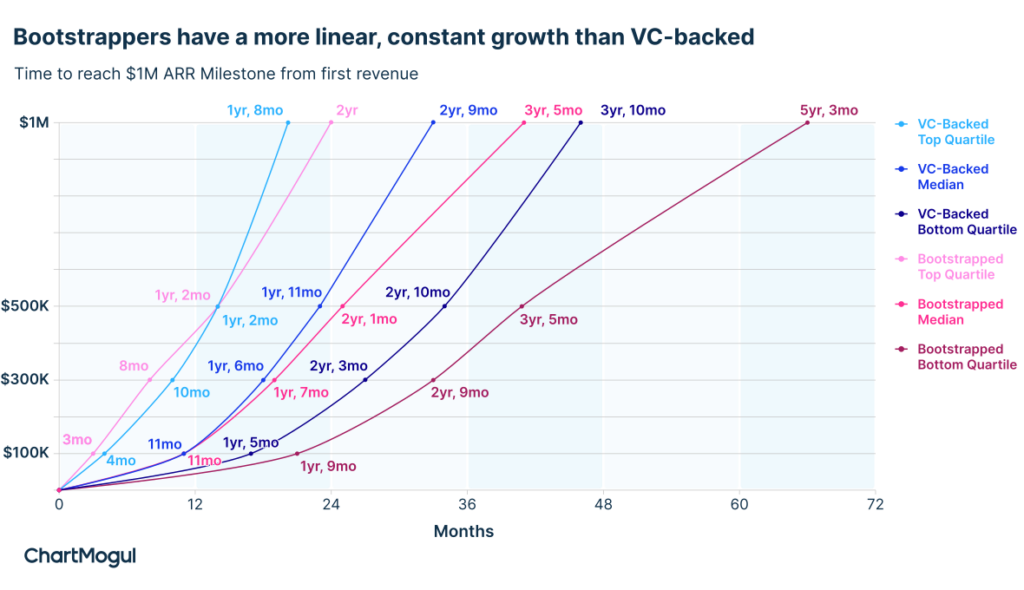

In this time-to-ARR milestone comparison chart we can see that there isn’t a lot of difference in performance between VC-backed and bootstrapped companies up to around $500K in ARR. Beyond that milestone the VC-backed companies generally start to pull away over time. The additional capital, combined with greater expectations on these companies to deliver outsized results likely play a big part in this divergence. But the reason for the branching is also partly self-fulfilling, it is after all much easier for fast growing companies to raise VC capital.

Compare your performance to the market with ChartMogul Benchmarks

In January, we launched ChartMogul Benchmarks, an on-demand and up-to-date snapshot of what good growth looks like for SaaS companies, allowing you to overlay your own performance and compare it with the rest of the industry.

ChartMogul turned 10 years old

ChartMogul was incorporated on October 1st 2014, so the company I founded officially turned 10 this year!

This milestone also places me in a fairly small minority within the tech industry – someone who has had the exact same job title for more than a decade!

ChartMogul’s most innovative year since its launch

At ChartMogul, we’re all-in for the long haul. Over half our team is focused on product development, ensuring we stay well ahead in Subscription Analytics while expanding our CRM offering. 2024 has been our most innovative year since launch, and we’ve still got a few product surprises to reveal before the holidays.

Product release highlights include:

Looking ahead to 2025, we’ve got big plans:

✨ Game-changing feature releases📊 Even more insightful industry reports🎥 Fun and engaging video content🤝 Many in-person and virtual events

You’ll see us at major SaaS events – SaaStr, SaaStock, SaaStanak, SaaSOpen → May 12th, 2025 (Austin), SaaSiest, ARRtist, Turing Fest and more!

To everyone in SaaS (and especially our incredible customers): here’s to a productive, profitable close to 2024 💪. The future looks bright—and I can’t wait to see what we build together.

P.S. We’ve done a similar post every year since ChartMogul launched. Check out the 2023, 2022, 2021, 2020, 2019, 2018, 2017, and 2016 posts.