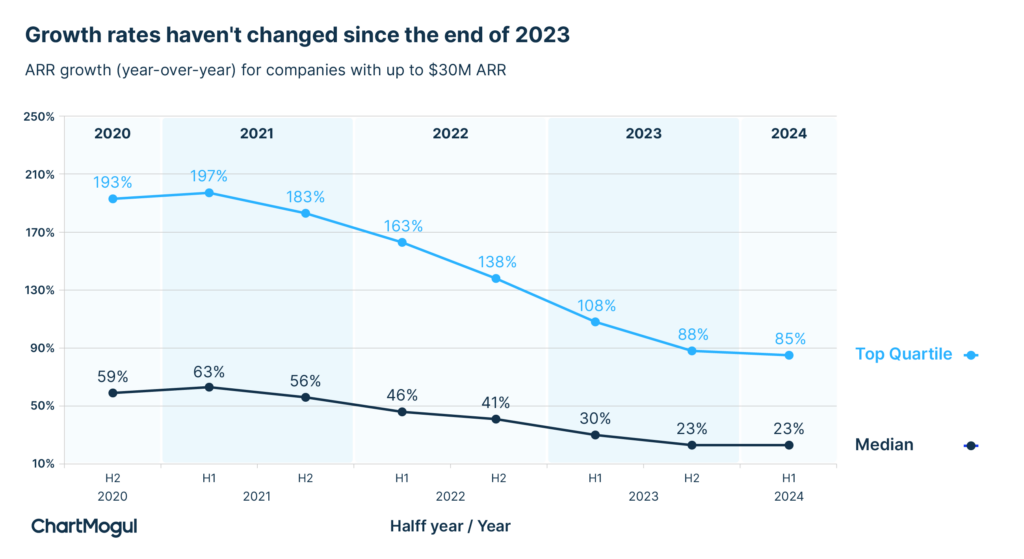

SaaS growth remains slow throughout H1 2024

ChartMogul‘s June SaaS growth data is here. The first half of 2024 is marked by a steady growth landscape for most SaaS companies. We continue to see glimmers of growth in certain ARPA segments after record-low growth rates experienced in 2023.

6 key insights:

ARR growth rate for June remains unchanged from the end of 2023, at 23%

The low growth rates continue into 2024, unchanged from 2023. In the first half of 2024, growth remained steady with median rates oscillating between 23% and 24%. June data shows no gain, but SaaS companies are still growing at a steadier pace.

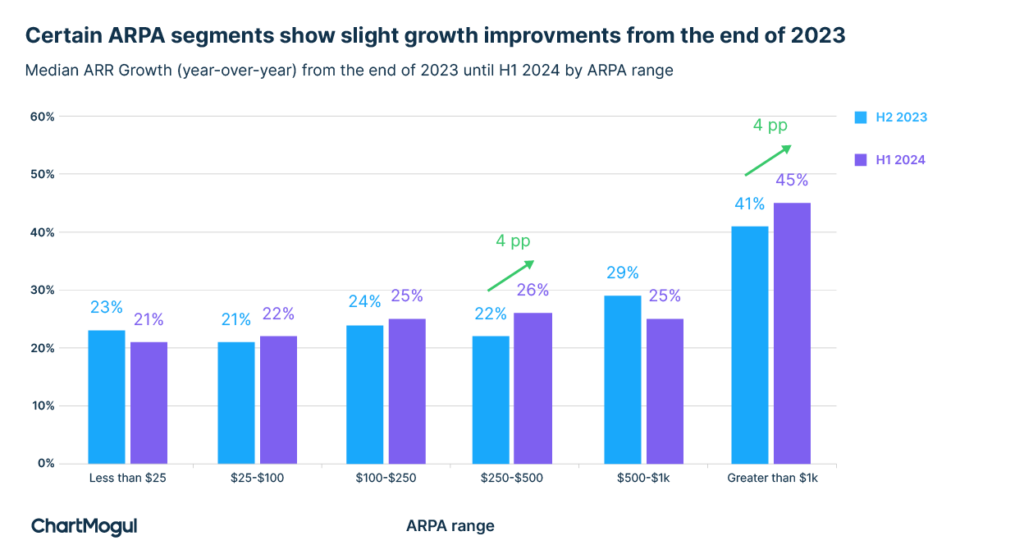

Two ARPA segments see growth improvements since the start of the year

SaaS companies with ARPA over $1k saw a 4pp improvement, reaching 45%, the highest growth since early 2023 (as seen in graph below). Similarly, companies with $250-500 ARPA grew by 4pp, hitting 26% in June. This segment has been gradually improving growth since the start of 2024, for the first time in three years. These small gains offer a glimmer of optimism for the future.

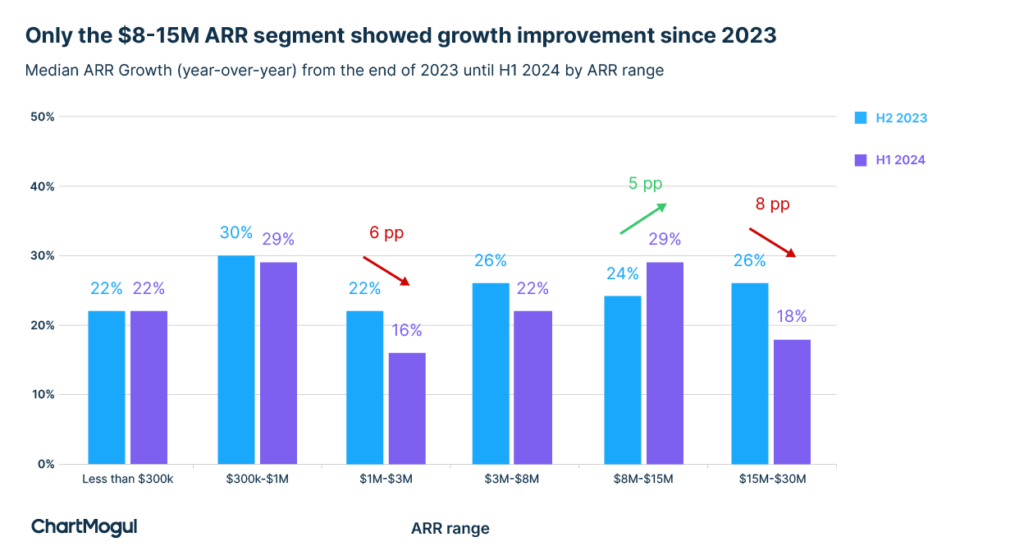

The $8-15M ARR segment is the only one that showed growth improvement from December 2023

This segment recorded a median growth rate of 29%, corresponding to a 5pp improvement (seen in graph below). After reaching record-low growth rates in late 2023, companies with $8-15M ARR have been gradually accelerating. The top quartile now grows at 68%, marking a 28pp improvement, the best quarter in the last two years.

June 2024 marks the lowest growth rate in the last four years for some segments

Companies with $15-30M ARR saw an 8pp drop since the start of the year, hitting record-low growth rates in June (as shown in graph above). Other segments, like companies with $1-3M ARR, also hit record lows, with growth rates dropping up to 6pp in the second half of 2024. Despite initial hopes, reigniting growth remains challenging for many.

Net Revenue Retention (NRR) improves 16pp from May for companies with ARPA over $1k

Companies in this segment recorded a median NRR of 97%. This is the highest NRR since late 2022 when it hit 100%. With growth rates improving for this segment, the data suggests these businesses are increasingly relying on expansion as a growth driver.

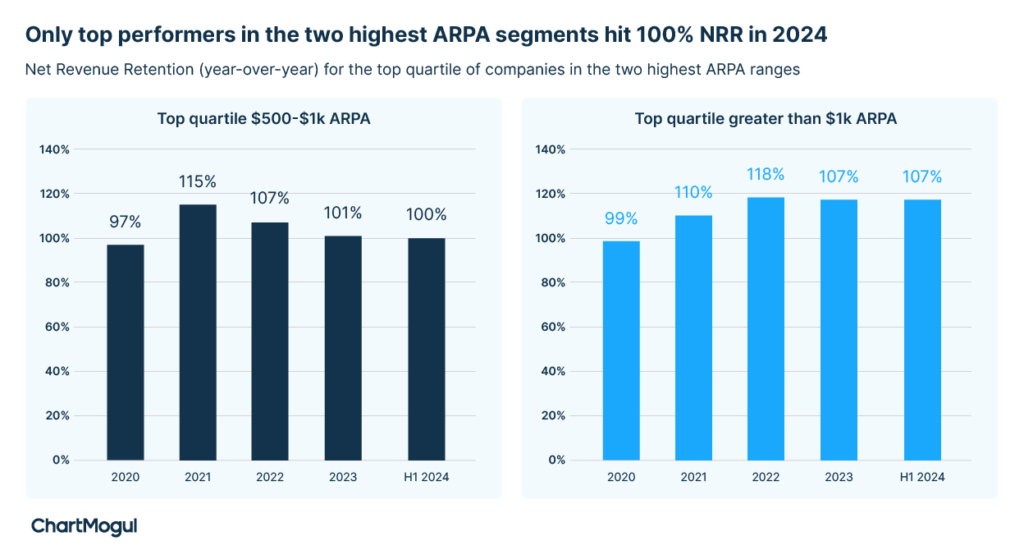

Only top performers in the two highest ARPA segments hit 100% NRR in 2024

The top quartile of SaaS companies with ARPA over $500 continue to achieve 100% NRR. However, NRR has been declining since its peak in 2021-2022. Growth is achievable even with NRR below 100%, but the recent recession highlights the resilience of top-performing SaaS companies that maintain an NRR of 100%.

Despite the challenges, the SaaS industry shows resilience and potential for recovery. Growth rates have stabilized at lower levels, with many SaaS companies continuing to focus on retention to drive growth.