What Should be Included in COGS for My SaaS Business in 2025?

In the evolving landscape of SaaS, understanding Cost of Goods Sold (COGS) is crucial for financial clarity and profitability. But what exactly is included in SaaS COGS, and why does it matter? This post will answer essential questions like: What are the components of COGS for SaaS companies? Should customer success be classified within COGS? We’ll also explore key considerations for calculating SaaS COGS, providing examples to ensure your business is accurately accounting for its expenses.

The Impact of Gross Margin on SaaS Valuations

Surprisingly, GAAP does not clearly define what should be included in a SaaS company’s Cost of Sales (COS; a.k.a. Cost of Revenue, COR, but most commonly known by the traditional term Cost of Goods Sold, COGS) so each company is pretty much left to its own judgment on what should be included. Below is our considered opinion on what to include in COGS for a privately-held SaaS company.

If what matters at the end of the day is growing cash flow, then why does it matter whether you put an expense above the line (in COGS) or below the line (in Opex)? It’s because gross margin percentage (GM%) is one of the most important metrics for SaaS company performance. Gross margin is used by investors and acquirers to gauge the quality of your revenue, and hence, valuation. A non-standard COGS definition can result in confusion and debate when trying to figure out just what a SaaS company is worth.

We have reviewed thousands of SaaS company financial statements, both before and after the adoption of ASC 606 (revenue recognition) and ASC 340 (cost recognition relating to contracts), and we have seen the full range of COGS definitions. Through that exposure, we recommend the below definition for three reasons:

What is Considered COGS in a SaaS Company?

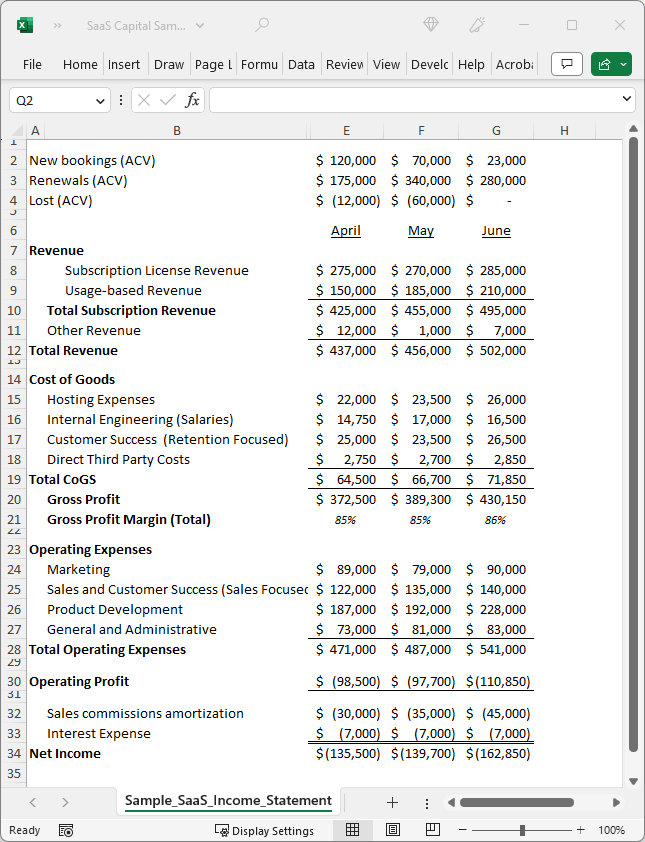

Under Cost of Sales/COGS for core SaaS revenue we recommend that companies report only the following categories:

These are all direct and primarily variable costs required to deliver the SaaS application. Generally speaking, if these expenses were not paid, the provisioning of the product and service to the installed base of customers would stop or deteriorate quickly.

Hosting costs should also include all core communication costs, and in the rare instance in which a company owns and maintains the servers used to deliver its product, depreciation on those owned assets. Since the vast majority of SaaS companies today use “cloud” or other off-site hosting, the need to include depreciation in COGS is a practice we rarely encounter.

Customer (or technical) support and customer success should include the salary and other direct costs of the team that is primarily focused on retention and satisfaction. Any appreciable portion of the CS team’s effort that is spent on upselling and cross-selling should be in its own operating expense line of included in sales. (See below for more about the distinction between customer success and account management.)

The salaries of the team responsible for keeping the production instance of the software up and running should also be included in COGS. All other R&D expenses should not be in COGS.

If your accounting practices make it practicable, use a “fully burdened” allocation of the employee costs that you put into COGS. (This generally means calculating overall employee overhead like taxes and healthcare as a percentage of salary numbers, and then increasing allocated departmental salary lines by that fixed percentage.)

The above definition is most consistent with what we see day-to-day and provides management with a solid view of the company’s contribution margin. Management can then decide how to invest that contribution margin back into sales, marketing, and product development on a discretionary basis.

About SaaS Professional Services and COGS

About those professional services… If your company has more than a negligible amount of revenue from implementation or services, it is a good idea to report those costs and revenues separately. Implementation is a different business than the ongoing provision of a SaaS product, and mixing those line items obscures the core economics of both. Without knowing the gross margin on pure SaaS license revenue, things like CAC Ratio cannot be accurately computed. Also, a SaaS business should absolutely know if it is making or losing money on professional services, and it should be doing so intentionally.

Second, professional services are a topic of guidance under ASC 606 and ASC 340. When to recognize professional services revenue and its related costs, hinges on whether such services are distinct from the delivered product itself. If the services cannot be sold separately from the SaaS product, then the revenue and expenses from such services must be allocated across the expected term of the customer contract. In other words, a SaaS company may need to capitalize its professional services expenses, instead of recognizing them when payment is received. (This is also true for certain below-the-line expenses like sales commissions.)

What Should Not be Included in a SaaS Company’s COGS

Things not to be included in COGS that we sometimes see included are:

We also discourage the allocation of other overhead costs into COGS. These are not direct variable costs, and allocation processes are time-consuming and generally inaccurate.

Differentiating Support, Success, and Account Management

In the early days of SaaS, software companies had a reactive model of customer support that was effectively “inherited” from on-premise licensed software, and focused on fixing (or working around) bugs or other problems. During the 2010s, a new best practice emerged of proactively monitoring and enhancing customers’ successful usage of software products, enabled in part by the greater visibility and adaptability of the SaaS model.

Should SaaS Customer Success be COGS?

This new discipline, termed “customer success,” was focused on creating more value both for customers (who would succeed in their objectives) and vendors (who would thereby increase retention). Customer success not only had an uplifting name and a feel-good, win-win mission, it also started becoming its own functional category with dedicated executives and a line in the P&L.

However, customer success underwent a form of “scope creep,” and it is now common to see the term applied to traditional, reactive support activities, account management, and everything in between. We’re fairly agnostic about what the “true” meaning of customer success vs. support should be, but we are very opinionated about what should go into COGS. When you look at the teams who have post-sales interactions with customers, where they sit on the P&L should follow the table below:

If the customer success team’s focus is on:

- Retention (over time)

- Customer Satisfaction/NPS

- Engagement/usage

- Enablement and fulfillment after a decision

- “Is part of” the product

… that team is in COGS under Support/Success

If the customer success team’s focus is on:

- Renewal (event)

- Bookings/Revenue

- Usage-based pricing

- Persuasion and facilitation of a decision

- “Sells/administers” the product

… that team is in Opex under S&M/Account Management

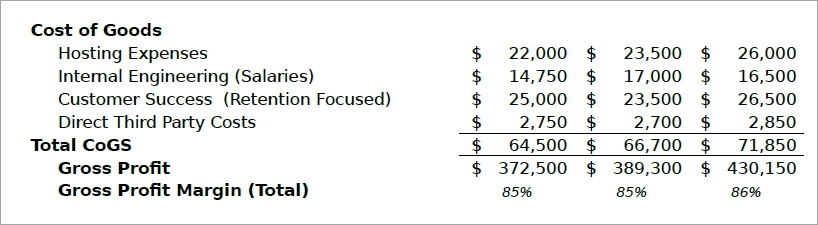

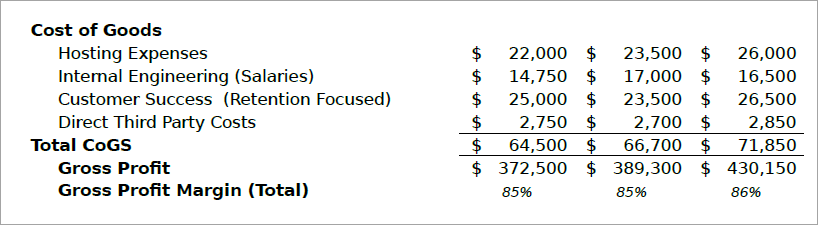

The core gross margin on SaaS license revenue is an important metric for all SaaS businesses. Gross margins on SaaS license revenue for companies in our portfolio and our annual survey data of private SaaS companies, as defined above, are generally 80% to 85%. Lower gross margin businesses might do very well, but they are fundamentally different in the way they are valued and operated.

Conclusion: What Are the Components of COGS for SaaS Companies?

Understanding SaaS COGS is essential for maintaining clear financial insights and healthy margins. We’ve outlined the key components that should be included in SaaS COGS and discussed whether customer success expenses should fall into this category. Calculating COGS accurately, factoring in direct costs like hosting and support, ensures a true reflection of your cost structure. As you assess what should be included in SaaS COGS, these considerations help refine your strategy for profitability and efficiency. Remember, proper classification is crucial for insightful financial analysis.

Note: A version of this post was first published in 2017, and continually updated to reflect current best practices. For more on SaaS accounting best practices, please see: What Should a SaaS Income Statement Look Like?

Click Below to Download the 2025 Sample SaaS Company Income Statement for How to Calculate Cost of Goods Sold for SaaS Companies

![]()