Growth, Profitability, and the “Rule of 40” for Private SaaS Companies

For SaaS founders, CFOs, and investors, most of the available Rule of 40 analysis comes from public company data. But private SaaS companies often show different dynamics: margins are lower, growth expectations vary, and benchmarks are harder to find. That’s why this analysis of private B2B SaaS survey data offers unique insights.

What is the Rule of 40 in SaaS?

The Rule of 40 is a shorthand metric used to evaluate SaaS company performance and relative attractiveness for equity investors based on growth and profitability. The formula is simple:

Revenue Growth % + Profit Margin % = Rule of 40 score

A score of 40 or greater signifies a strong performing company while a score below 40 can indicate a company is struggling to scale effectively.

Why the Rule of 40 Matters for SaaS Companies

Despite its simplicity (and its critics) the Rule of 40 remains a widely referenced benchmark among investors, CFOs, and founders. It offers a quick snapshot of whether a company is scaling sustainably. Companies that exceed the threshold often enjoy higher valuations and stronger investor interest.

Goodhart’s Law and the Limits of the Rule of 40

Goodhart’s law (named after the British economist Charles Goodhart) states that once a measure becomes a target, it ceases to be a good measure. Such is the case with the strict adherence to the Rule of 40. Adding up year-over-year growth rate and EBITDA margin (as if they are interchangeable and exhaustive) was never a complete picture of a SaaS company’s success or relative standing. (See The Rule of 40 is Dead… Long Live the Rule!)

But criticisms aside, the Rule of 40 does provide a handy snapshot of a company’s trailing performance in two vital areas, and examining its composition (if not its final sum) can illuminate important trends for a company or, in aggregate, for the SaaS industry.

It is in this spirit that we looked at how respondents to our annual survey of private SaaS companies performed on this measure and how this compared to recent history.

Key Rule of 40 Findings from Our Annual SaaS Survey

In analyzing the data, we segmented respondents into different ARR buckets, as well as by whether they were bootstrapped or equity-backed.

Our high-level findings are presented below:

- Bootstrapped companies outperformed their equity-backed counterparts, but the gap has narrowed over the past two years.

- Rule of 40 scores have contracted noticeably over the past two years, regardless of company size or funding source. This is most pronounced among bootstrapped firms.

- Falling revenue growth rates are the primary driver of this slowdown across both equity-backed and bootstrapped companies.

- Equity-backed companies made noticeable improvements in profitability, although the median company remains unprofitable. In contrast, the median bootstrapped firm is profitable but saw its margin decline.

Falling Rule of 40 Scores (Nearly) Across the Board

The reader should focus on direction and change in the numbers below, rather than their absolute values, which contain noise from different reporting and categorization approaches by company.

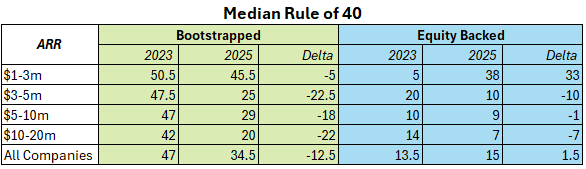

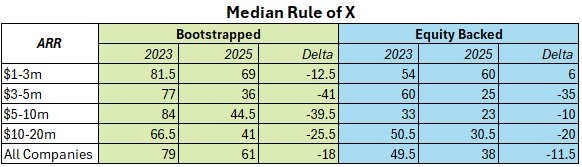

The table below presents Rule of 40 scores for the median company, segmented by ARR size and funding source: bootstrapped or equity-backed. The data is from the 2025 and 2023 SaaS Capital annual surveys.

Several observations jump out.

- Aggregate scores generally declined from 2023 to 2025 across almost all ARR sizes and regardless of funding source.

- The sole exception was equity-backed companies with ARR between $1-3 million, which saw a jump in overall score driven by a dramatic reduction in operating losses.

- The median bootstrapped company continues to outperform the median equity-backed company on this metric. However, the performance gap has narrowed over the past two years. Indeed, across all ARR scales examined, the median bootstrapped company score declined more than that of the median equity-backed score. At least on this metric, equity-backed companies have closed the gap, although it is a fascinating question as to why such a gap existed in the first place.

Growth Slowdown: The Main Rule of 40 Driver

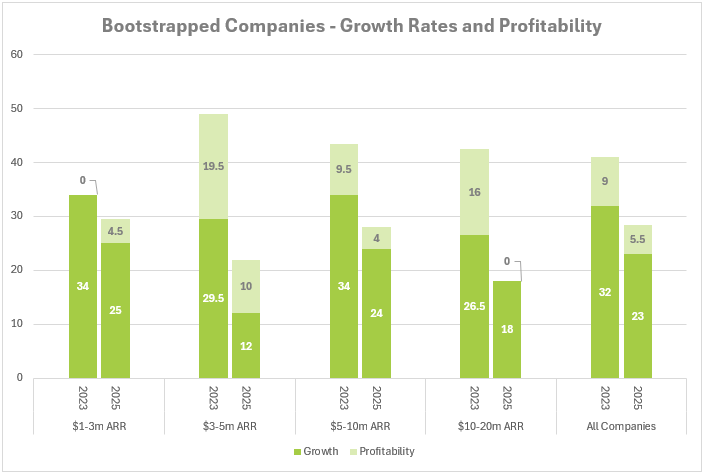

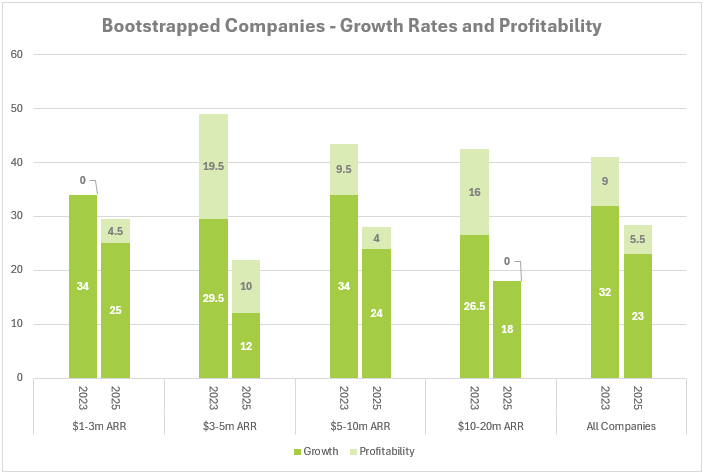

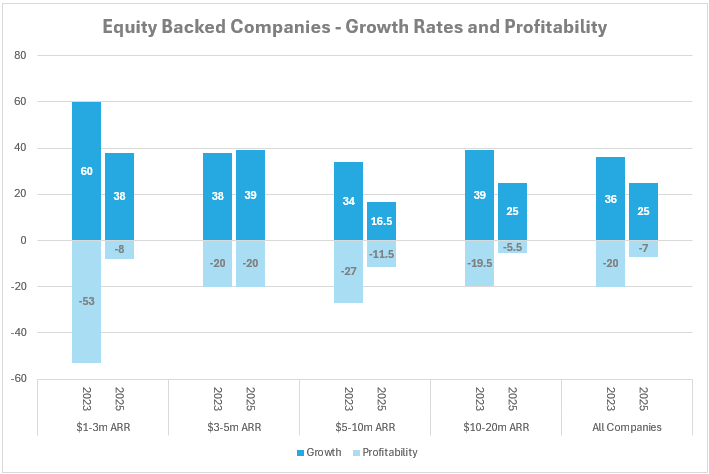

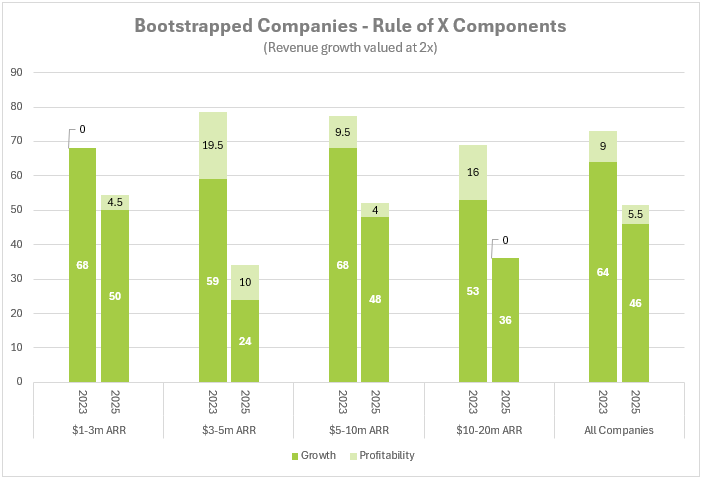

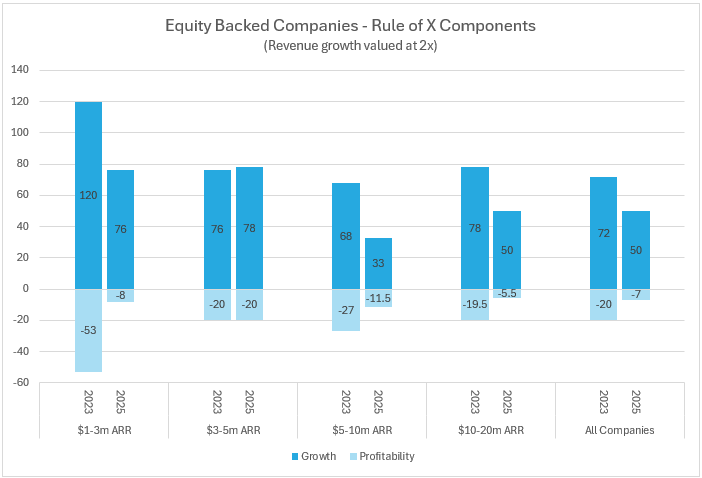

The two charts below depict median growth rate and profitability by revenue scale for both equity-backed and bootstrapped companies. Note that these values may not sum to the median Rule of 40 scores presented in the above table. (Note: taking the median profitability and median growth rate and summing them will not necessarily yield the same result as calculating the Rule of 40 for each underlying company and then taking the median from this dataset.)

Looking at the disaggregated Rule of 40, we see the primary driver for declining Rule of 40 scores is the slowdown in revenue growth rates. Declining growth rates have been evident in both the public and private SaaS space for several years now. This has occurred regardless of funding type or revenue scale.

Despite this universal decline, growth rate remains the primary contributor to the aggregate Rule of 40 score. Said differently, growth rates remain meaningfully higher than EBITDA margins for the median company across all revenue scales considered. Of course, this is hardly surprising as we are looking at growth-stage companies. Even if we have moved past the “grow first and ask questions later” stage in the SaaS industry, growth remains the primary target for operators and investors alike.

On the whole, equity-backed companies show higher revenue growth rates. Although the reason for this is up for debate, whether companies with higher growth rates are able to attract equity backing or whether equity backing enables faster growth.

Rule of 40 Profitability Trends: Equity-backed vs. Bootstrapped

If growth rates have been a universal headwind to Rule of 40 performance over the past two years, the contribution of profitability is a different story, and one that largely turns on whether the company is equity-backed or bootstrapped. Accepted wisdom is that bootstrapped companies tend to be more conservative in terms of spend. Median company data support this. Across all revenue scales, the median bootstrapped company was either breakeven or profitable in both survey years. It is noteworthy, however, that overall profitability for bootstrapped companies declined from the 2023 survey to the 2025 survey, with the sole exception coming from the $1-3 million in ARR category.

Equity-backed companies exhibit a different trend. Whether by force or choice, these companies have reduced their burn rate. The most dramatic reduction came from the $1-3 million in ARR category, which saw median profitability improve from -53% to -8% over the last two years. On the whole, equity-backed companies are still unprofitable, but the past two years have seen a significant improvement on this front.

Given the financing environment, the movement to reduce burn makes sense, particularly in the face of industry-wide growth headwinds. For companies unable to achieve top-tier growth rates and secure the next funding round at attractive valuations, managing spend, extending runway, and increasing optionality is the next best choice.

Rule of X: An Alternative to the Rule of 40

The Rule of X has been offered as a replacement for the Rule of 40, particularly for companies that are near or have reached operating profitability. It addresses the criticism that revenue growth rate and profitability should not be weighted equally by overweighting growth. The particular overweight assigned to growth varies by analysis. For our purposes we assigned growth rate a 2x weight relative to profitability. For example a company growing at 25% year-over-year with EBITDA margins of -10% would have a Rule of 40 score of 15 (25 – 10) and a Rule of X score of 40 (25 x 2 -10). Again, we believe readers should evaluate scores on a relative and directional basis rather than focusing on absolute values.

Below we share Rule of X results for the median company segmented by ARR size and financing type.

Overall, the key findings from the Rule of 40 analysis do not change when switching to the Rule of X:

- Rule of X scores declined meaningfully from the 2023 to 2025 surveys. Bootstrapped companies saw the largest declines.

- Bootstrapped companies outperformed their equity-backed counterparts on this measure in both periods; however, the gap between the median bootstrapped and equity-backed company shrunk.

One notable difference is that the relative performance gap between equity-backed and bootstrapped companies narrowed when using the Rule of X framework compared to the Rule of 40. This makes intuitive sense as the equity-backed companies exhibit higher growth rates. Applying a greater weight to growth necessarily causes equity-backed performance to improve relative to the unweighted growth framework in the Rule of 40.

Rule of 40 Conclusion & Key Takeaways

The Rule of 40 is not a perfect metric, but it remains a useful lens on SaaS company performance. Growth continues to be the dominant driver, though profitability trends are shifting as equity-backed companies reduce burn. Bootstrapped companies still hold the edge on this metric, but the gap is narrowing.

- Rule of 40 is still relevant as a shorthand benchmark, even with its limitations.

- Rule of 40 scores have declined noticeably over the past two years, driven by slowing growth rates.

- Bootstrapped firms remain stronger on profitability, though equity-backed peers are closing in.

- Overall, bootstrapped firms outperformed their equity-backed peers, but the performance gap is narrowing as equity backed companies reduce burn.

The lesson for SaaS operators: long-term success comes from balancing growth with a path to profitability rather than over-indexing on either.

![]()