2024 Growth Benchmarks for Private SaaS Companies

Based on SaaS Capital’s 13th annual B2B SaaS1 company metrics survey, growth across most revenue brackets (ARR categories) growth has decreased or remained stable from 2022 to 2023. Bootstrapped companies faced a decline in growth rates across all revenue brackets, particularly at higher ARR levels. In contrast, equity-backed companies showed mixed performance, with early-stage firms (those under $1 million ARR) experiencing strong growth, while mid-tier companies saw either modest growth or slight declines. Across most ARR categories, growth rates decelerated from 2022 to 2023, with the largest drops occurring in companies earning $10-$20 million in ARR. Equity-backed firms, especially those in the lower revenue brackets, demonstrated greater resilience compared to their bootstrapped counterparts.

Best Practices for B2B SaaS Growth Metrics

Benchmarking your SaaS company’s performance against public SaaS firms may seem straightforward, but it has its limitations. The vast size disparity between public corporations and smaller, privately held ones can lead to misleading or distracting comparisons. To address this information gap, we initiated our annual survey a decade ago, aiming to assist small, private companies in gaining better insights into how they fare compared to their peers. Our survey places emphasis on tracking key SaaS metrics, one of which is revenue growth. Along with profitability and retention, your company’s growth rate significantly influences its valuation multiple. Furthermore, how you stack up against similar-sized and staged companies determines whether you might receive a valuation premium or discount relative to your peer group’s median valuation.

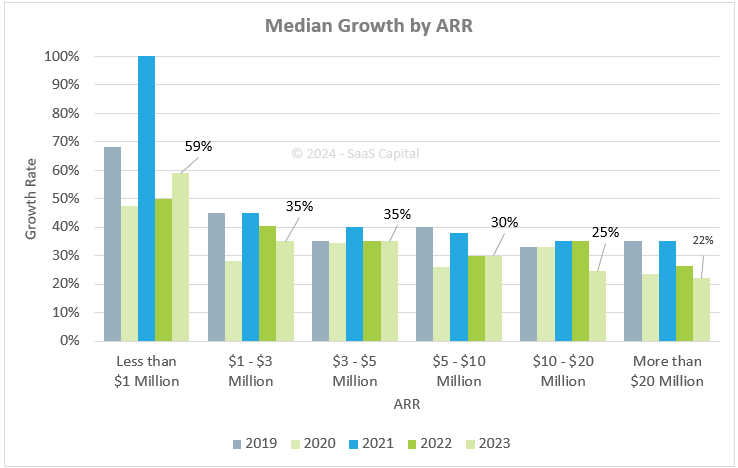

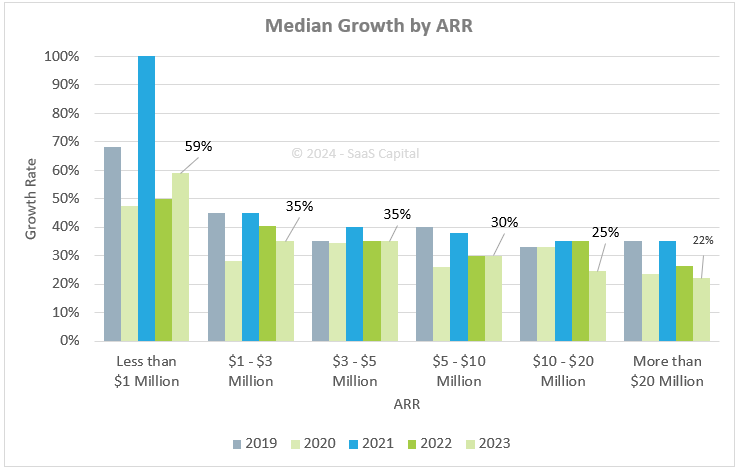

Private SaaS Growth Rate Benchmarks by Company Size

A comparison of how fast your SaaS business is growing versus others’ growth rate is only relevant when you are comparing similarly sized businesses. A growth rate of 30% for a $4 million SaaS business is below the median, while growth of 30% for a $20 million SaaS business is above the median. Despite identical growth rates, the smaller company might be worth 3 times revenue (as a relative laggard), while the larger might be worth closer to 10 times revenue (as a champion among its peers). The chart below shows median year-over-year (YoY) growth broken down by Annual Recurring Revenue (ARR) for 2019, 2020, 2021, 2022, and 2023.

What is a Good Growth Rate for a SaaS Company in 2024?

The overall median growth rate for all companies in the survey registered 30%. This is down from an overall median of 35% reported the previous year and puts growth closer to the pandemic levels seen in 2020.

The data confirms trends we’ve been observing in the market. In mid-2021, public company valuations reached a peak, with a median of nearly 17 times their current run rate ARR. However, by the first half of 2022, valuations dropped significantly and stabilized in the current range of 6.0 to 7.0 times ARR. Private capital markets also slowed down, and with funding becoming scarce, SaaS companies have been forced to prioritize profitability over growth. This shift, along with ongoing economic concerns and reports of longer sales cycles, has led to slower growth overall. However, it is worth noting that while growth slowed, the overwhelming majority of respondents still posted positive growth. Overall, 5.3% of the companies reported flat or negative growth in 2023, which is up from 3.1% last year but well below the 13% reported in 2020.

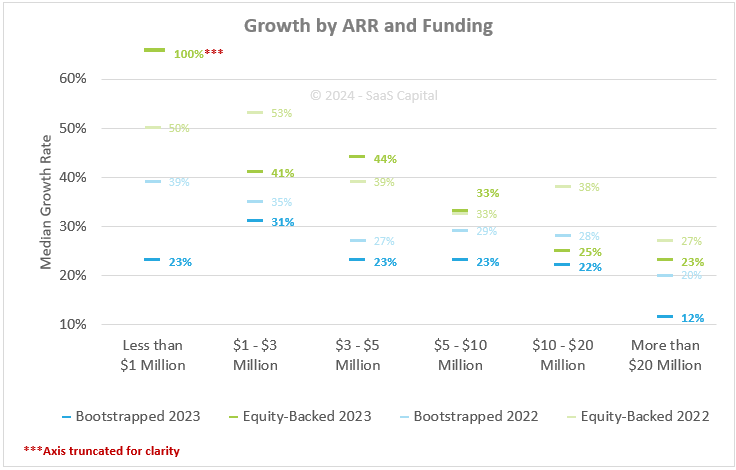

Private SaaS Growth Rates by Funding Type

The chart above shows the median growth rates for equity-backed and bootstrapped companies in 2023 versus 2022, broken down by ARR.

Historically, we have seen that equity-backed companies report higher growth rates than bootstrapped companies. And while it’s not clear which is the cause and which is the result since investors look to back companies that already show signs of being high performers, understanding the difference is important for benchmarking.

Bootstrapped companies report a consistent year-over-year decline across all company-size categories. On the other hand, equity-backed companies experienced mixed results, with substantial growth among the smallest companies, but significant declines in others, particularly in the $1-$3 million and $10-$20 million ranges.

The venture capital gamble is that selling some of your equity for cash for you to spend on growth will allow you to achieve a certain ARR level and growth rate faster than a bootstrapped version of yourself. SaaS valuations are calculated as multiples of ARR, and the single biggest driver of the multiple is the growth rate. So, a higher growth rate should result in a higher valuation multiple, sooner in the company’s timeline than you would have otherwise achieved by staying bootstrapped. In raising venture, you hope this increased valuation multiple more than offsets the dilutive percentage sold off to investors (AKA, a smaller slice of a bigger pie).

Through our decade-plus of lending to SaaS companies, we have empirically seen that raising venture capital does not change growth rates in a meaningful way. It is far more likely that the VC-backed companies in the survey were already growing quickly before they raised outside capital. This is important to understand as you contemplate the “VC gamble.” Now, venture capital can have real, positive impacts like an accelerated product roadmap, external validation and network effects, and a war chest for acquisitions. But it is important to be honest about how hard it is to bend the growth curve. Acknowledging our bias as a lender, we consider the engine (the company’s business model and product-market fit) as far more important than the type of fuel (the capital). Pouring VC “rocket fuel” into a rocket may work fine – but it won’t transform a Ferrari (or a Honda) into a spaceship.

Other Takeaways on Private SaaS Growth

The full Research Brief offers additional commentary on the data above as well as breakdowns on growth rate by funding type, growth rate and retention, and growth rate by company age. Key takeaways include:

- The median growth rate for all companies in the survey registered 30%. This is down from a population median of 35% in 2022 and puts growth closer to the pandemic levels seen in 2020. Overall, 5.3% of the companies reported flat or negative growth in 2023, which is up from 3.1% last year but well below the 13% reported in 2020.

- Bootstrapped companies report median growth of 25%, down from 32% in 2022. Equity-backed companies reported median growth of 30%, down from 35% in 2022. Growth rate is positively and exponentially correlated with net revenue retention. Increasing Net Revenue Retention (NRR) from the 90% to 100% range to the 100% to 110% range improves growth rate by 10 percentage points. Companies with the highest NRR report median growth that is more than double the population median. This is a rare example of increasing returns from investment in upsells and cross-sells.

- Continuing a pattern we have observed over the years, overall average annual contract value (ACV) levels do not appear to have an overall correlation with growth rate. However, a recent analysis – Changing ACVs: The Hidden Control Lever of SaaS Company Value – revealed that companies that were showing higher ACV growth tend to grow faster, and those with flat to shrinking ACVs grow the least. In other words, increasing ACVs over time is an important component of scaling a SaaS company.

- Additional perspectives on growth can be found in Comparing Revenue Growth Trends in the Public and Private SaaS Sectors and Why Long-Term SaaS Revenue Growth Rates are Slowing; and What it Means for Your Private B2B SaaS Company.

To download the full analysis, please see – 2024 Private SaaS Company Growth Rate Benchmarks.

1 In Q1 of each year, SaaS Capital conducts a survey of B2B SaaS company metrics. This year marked our 13th annual survey, and it continues to grow with more than 1,500 private B2B SaaS companies responding, making it the largest survey of its kind.

![]()